Juanita Gonzalez’s family went four months without paying their house’s mortgage payment after the economic effects produced by the subprime mortgage crisis.

“When the recession started, that is when it became difficult. Jobs stopped. My husband has a very habitual job, he’s in construction,” Gonzalez says.

The homemaker, who is a Mexican immigrant and a resident of San Bernardino for the past eight years, faced a dilemma shared by both citizens and even the city itself – a shortage of money to pay necessary bills.

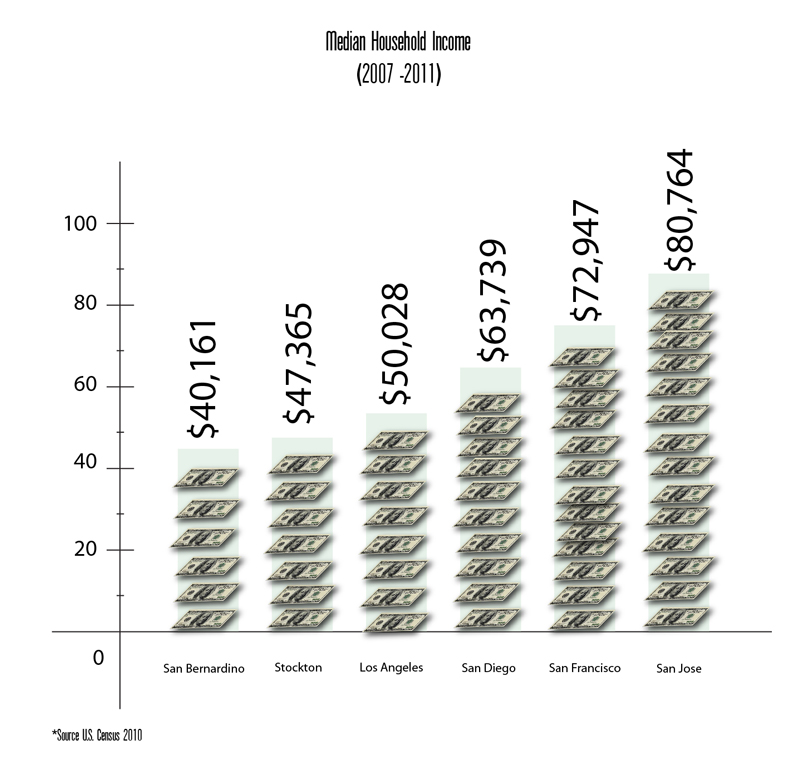

San Bernardino is the country’s second-largest poorest city after Detroit, Mich., with 28.6 percent of the city’s population living below the poverty line — nearly double the state average, according to the 2010 U.S. Census.

Exacerbating the situation is the city’s own financial problems. In July 2012, the city reported it had $150,000 left in its bank accounts.

The following month, it filed for bankruptcy protection.

Housing a ‘Contributing Factor’ to San Bernardino’s Economic Decline

The city’s housing economy was among the contributing factors that eroded its financial situation. Prior to the recession, San Bernardino and the surrounding Inland Empire experienced an upswing in housing construction as well as a surge in houses bought by Hispanics.

But the same Hispanics who were eager to buy the American Dream of homeownership were also some of the most affected by foreclosures and defaults of subprime loans, targeted by coalitions and government groups eager to sign on the dotted line. The Inland Empire region became a staggering statistic in the wave of minorities facing foreclosure.

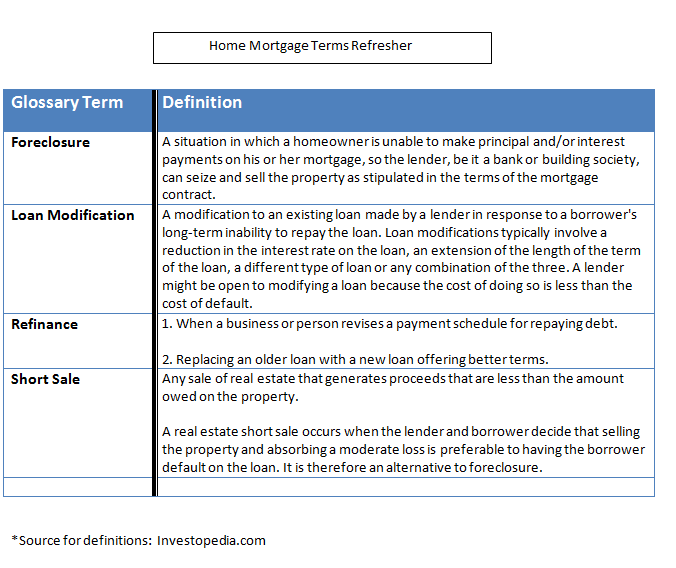

Gonzalez had already refinanced her home when the “houses weren’t falling, they were still at a good level,” Gonzalez says.

She says she never tried to research or find out more information on her own about real estate. She asked a friend for information on who could help with the refinancing of her home once she fell behind on payments.

This lack of resourcefulness on the part of homeowners plus the absence of shared knowledge from multiple institutions is what Patricia de Santos, a local educator in real estate and real estate professional, says played a part in the housing crisis that hit the San Bernardino area.

“There was lack of information from the city and lack of information from the homeowners. As well as information asymmetry ‘I know what you don’t know’ from the banks….there were many factors, many players in this,” de Santos says.

De Santos says although cities may regain back some of the lost property tax revenues, when and at what rate is unsure.

Tom Pierce, an economics professor at California State University, San Bernardino, says that although it should be noted that the decline in property revenue is not a sole factor for San Bernardino’s economic state, it is a contributing factor.

“In San Bernardino’s case, one of the contributing factors to reduced revenue that hurt in the budget was with the housing collapse. A lower value of people’s homes contributed to the budgeting balance in relation to spending and revenue collected. Lowered tax property revenue is one reason revenue shrunk,” Pierce says.

Chas Kelley, one of San Bernardino’s council members and representative of the fifth ward in the city, also agrees.

“There is never a single component or single one factor that would contribute to the decline of a municipality,” Kelley says.

Yet the domino effect of a citizen’s foreclosure does affect multiple aspects of a city’s tax sector.

With a foreclosed home, the property revenue tax goes down because the home is now assessed at a lower value, therefore reducing the property tax revenue to the state, county and city.

Kelley says when there is an empty home, not only does the property and utility taxes a city collects go down, but also the people in that home do not patronize local businesses because of scarce money, affecting the sales and business taxes of local business owners.

Strained Economic Resources

Once called “The Valley of the Cupped Hand of God” by local tribes people, this city of 213,000 residents is now clenching onto its strained economic resources.

Factors other than the housing economy officials cited included loss of sales tax, high pension payments, the closing of a redevelopment agency in the city (which previously had helped provide revenues), the shutdown of major plants such as the Norton Air Force Base – all while dealing with its high unemployment rate and high crime rate, which stretched the public service in an already thinning economy.

In the July 2012 special budgets meeting, advisors to the city say that one major problem of the city occurred when spending kept increasing while revenues were declining.

To help keep the city on track, the council voted for a reduction of $6.2 million towards the city’s police department. Public Information Officer Lieutenant Paul Williams said although patrolling officers were not cut, responses to non-emergency calls have taken longer. Homicide increased by 45 percent in 2012 compared to the same data in 2011, Lieutenant Williams said.

The city has closed some operating days and hours of its public library branches and has even asked its citizens to volunteer in a variety of public services (including code enforcement) to alleviate its financial stress.

Hispanics Feel City’s Economic Decline

With a Hispanic population of 60 percent according to the latest census data, the large minority population here, which includes Otelio Loeza, experiences the effects of high unemployment and the rise in government aid.

Loeza walks along the banks of the Seccombe Lake Park near San Bernardino’s downtown area since it is one of few free activities he can enjoy. He moved to the city from Los Angeles County a year ago in search of better opportunities, but that dream has fallen short, as he is currently part of the 15 percent unemployed.

“I haven’t seen much of an atmosphere of where I can find a job,” Loeza says.

“Most of all, I’ve noticed that a majority of the people here live on the help of welfare. Every time that I go to the store, I see people paying with those cards [EBT cards], and in Los Angeles people pay with credit cards, their money – cash,” says Loeza.

Without cash readily available by customers, local businesses (32% of city businesses are Hispanic-owned firms states 2010 census data) around the city also suffer. Hector Cruz’s family owns Angie’s Bakery, which opened its doors five years ago.

“The past year until now, the economy has affected the rent and revenues, in terms of receiving funds. People now do not come in with cash, a lot of people come in with government assistance, or EBT as it’s called now, “Cruz says.

“That affects us because it delays the money that we used to get at the moment, now we get funds at the end of the month. This makes it difficult to pay bills,which are not due at the end of the month, but instead are paid in the middle of the month. At times we have to pay charges late, which affects us,” he says.

Glimmer of Hope in Housing Economy

Despite all of its circumstances, signs of revitalization to its economy are starting to show.

Local real estate professionals, like mortgage and real estate broker Bob Rice, say housing values have started to level off and short-sales are more common than foreclosures now. According to Realtytrac.com, a site that publishes foreclosure data, the rate of houses that were at some point of the foreclosure filing process in the city was 1 in 68 homes in December 2008. Now, the site’s data shows a city rate of 1 in 282 homes in foreclosure filing in December 2012, an improvement over the rate of 1 in 252 homes in foreclosure filing for its November 2012 data.

Community’s Need for Change

While it may take longer for the city to escape its own financial gloom, citizens can play an active role in defining themselves economically.

San Bernardino real estate agent Maribel Mendoza from Spellacy ( a real estate and property management office) says she knows what it’s like to lose her home, and that is why she is trying to educate the Hispanics in her workplace of San Bernardino.

When trying to refinance her second sub-prime loan for her home in neighboring Rialto, Mendoza says that is when the market went down and she had no equity in her house. As payments went up, her situation depressed.

“When this happened to us, there was nothing about loan modification. There was really no help. […] The people that lost their homes or were in trouble before 2009 really had no options,” Mendoza says.

The mounting payments took a toll on her marriage and health. Mendoza and her husband decided to alleviate some of the pressure by making a ‘cash for key’decision, which allows homeowners in real estate owned property to turn in keys to a house still in good, clean condition. She received $2,500 and used the money to rent a house in nearby Colton, where she still resides.

“I guess if you want to say, it’s good that I lost the home, because now I know the people that I am talking to [I know] how they feel,” Mendoza says.

Now she tries to help out homeowners, especially Hispanics, in the same predicament. Mendoza helps host free, bilingual monthly seminars to educate people on different options, such as short sales, loan modifications, or even bankruptcy . She says a short-sale can give dignity to a homeowner, allowing them to leave on their own terms instead of being evicted.

Laws have also been enacted to protect and aid potential homeowners in the mortgage process. California passed the Homeowners Bill of Rights in January 2013 and earlier in the same month, federal regulators ordered 10 major U.S. banks to resolve homeowners’ claims of abuse during the foreclosure process.

Yet both Mendoza and de Santos encourage consumers to educate themselves.

Mendoza says many Latinos count on what a neighbor or friend says, but that every situation is different and needs to be treated uniquely.

“When you are signing a document, please read,” Mendoza says. “Ask for the documents in Spanish.”

De Santos says homeowners cannot rely on new laws as a catch-all for problems.

“Homeowners need to know they have something to go back to that protects them. The Homeowners Bill of Rights is a protection remedy – it will not do anything unless there is a problem, “ de Santos says.

As for civil service, Mark Pisano, a senior fellow at the USC Sol Price School of Public Policy who recently completed a case study on the economy of San Bernardino through the Haynes Foundation, says San Bernardino citizens can enable change.

This primarily rental, low-income city “leads to a very depressed center of finances. External factors lead the city into financial strain coupled with the internal factors,” Pisano says.

One of the internal factors, Pisano says, is the fact that San Bernardino is one of the largest cities in California still under charter law.

While cities governed by general law handle finances through a budget process, San Bernardino used its charter law to establish the provision that was passed by voters to take the average salary of ten surrounding cities in order to set salaries for public employees, such as the fire and police departments. The fault in a system like this, Pisano says, is that San Bernardino compared itself to cities that were in very different economic situations – often more affluent.

Pisano says that although it is not easy to change from a charter to a general law, it all comes down to the vote of the people. In essence, the citizens of San Bernardino can actively try to change their economic fate.

“If they seek responsibility and authority, it rests with the citizens,” Pisano says.

The citizens – and city- of San Bernardino showcase that knowing financial and civil information, as well as checking to see what goes in and out of their pocketbooks, can aid in ascending into financial freedom.

–A Spanish, condensed version of this story was published in the print version of El Punto’s 1/23/13 edition.